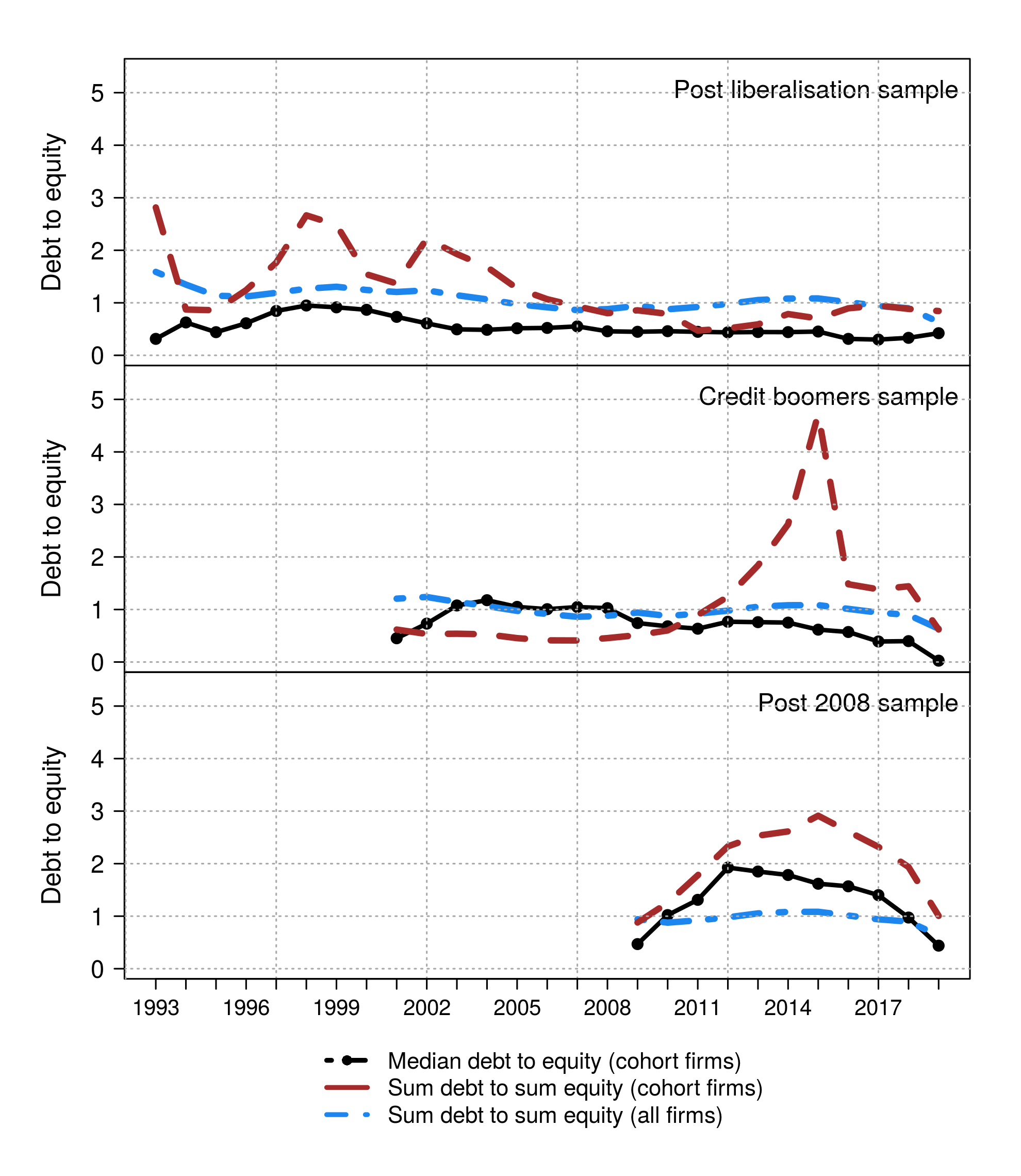

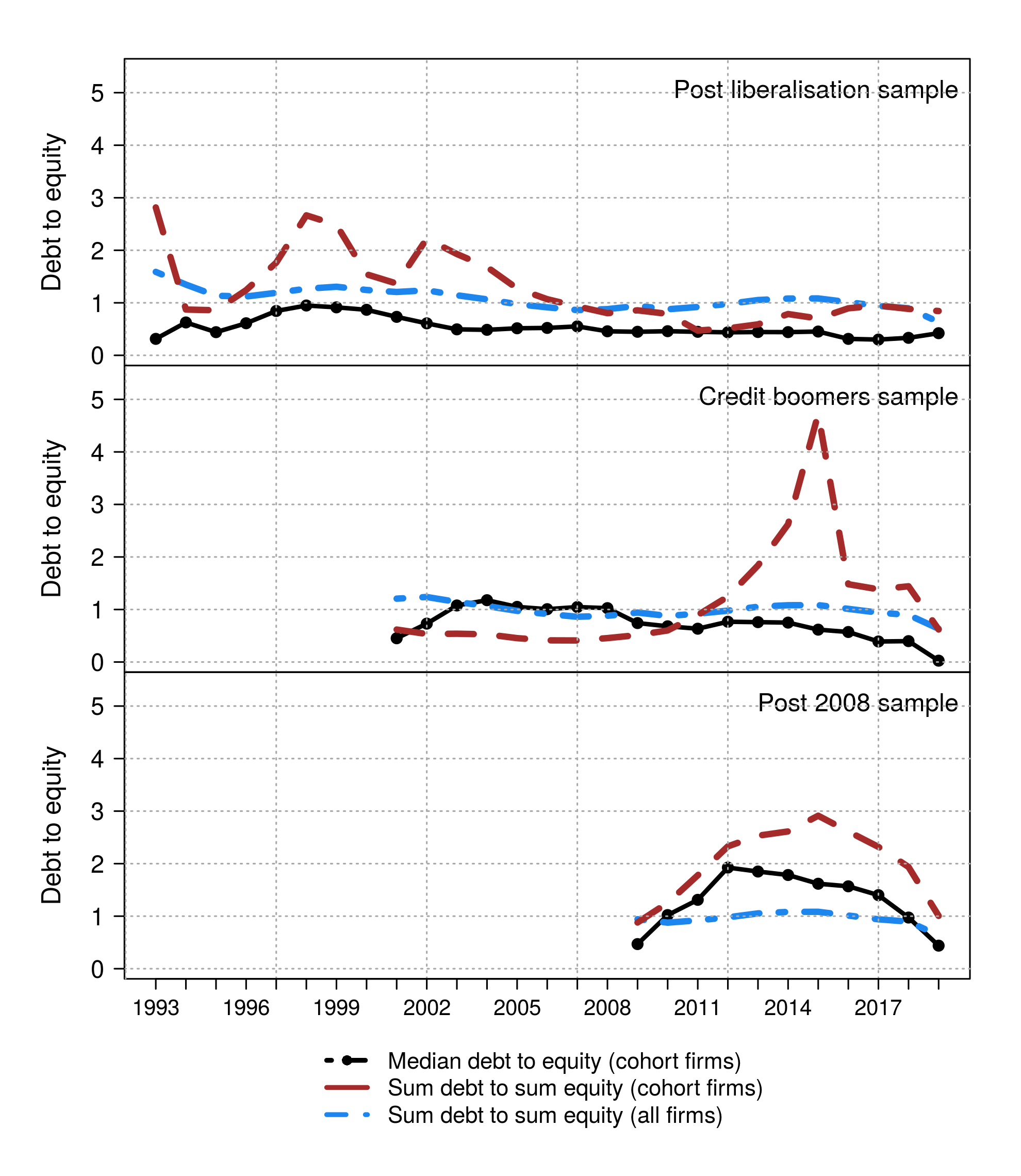

Cohorts definition:

- Post-liberalisation sample:

- firms incorporated in any of 1992/1993/1994

- with first year of reporting within three years

of incorporation

- Credit boomers sample:

- firms incorporated in any of 2000/2001/2002

- with first year of reporting within three years

of incorporation

- Post 2008 sample:

- firms incorporated in any of 2008/2009/2010

- with first year of reporting within three years

of incorporation

Variable definition:

- Debt: Debt on a firms balancesheet adds

to the total amount of money it is expected to pay

to its creditors. The components used to arrive at

firm's total debt are total borrowings (all types),

paid up preference capital, share application money

no transferred to share capital account, and shares

that have been allotted but not yet issued (in the

share suspense account). This indicates to the total

sum of money that has to be repaid by the firm over

time.

- Total equity: Total equity refers to the

value of the firm after all its liabilities are

repaid. It has been computed as sum of equity

capital (both paid up and forfeited) and

reserves. Revaluation reserves are removed from

reserves to maintain comparability between

firms. Miscellaneous expenses are also deducted

since these have already been incurred, and are no

longer part of the firms own funds.

Database used: CMIE ProwessDX